“Every day we respond, and we attach ourselves to the worst day of somebody’s life.” [see Phil Melnychuk, “Online program gives firefighters some advance notice about the trauma and tragedy they’ll face”, Delta Optimist, March 20, 2024]

That’s the way Captain Ben Lewis recently described the

nature of a firefighter’s job. Extracting a car crash victim, saving multiple

lives at a fentanyl overdose scene, recovering the charred body of a child from

a house fire. Attending the worst day of somebody’s life every day, day after

day, can take its toll on firefighters and other first responders serving our

communities.

The apparent rise in mental injuries

First responders are not the only workers at risk of mental

or psychological injuries. Many workers’ compensation jurisdictions and

work-disability insurers have noted increasing mental disorder (also called psychological

injury, mental injury) claims over time.

In this post, we survey some of the data reflecting this

increase. We will explore some of the

reasons for the increase. In a later post, we will look more closely at the

drivers behind current trends. We will

also discuss some of the challenges in

comparing data across jurisdictions and prevention strategies that might impact

the trajectory of future trends.

Important note on Terminology

This is intended as a general discussion document and will

use several different terms. This requires

a caution with respect to terminology.

Certain terms may carry negative connotations, confer a

sense of blame, or infer a flaw in an individual. The terms used in this post are

reflect the terms most often used in diagnostic, policy, coding, statistical

and legislative data being discussed.

Psychological injury, mental disorder, mental illness, mental

impairment, mental health injury, and other terms used here often have specific

meaning or legal definitions that apply to in specific jurisdictions. There are also other terms that I have not used

in this discussion but may be included in the categories discussed here. For

example, operational stress injury and military sexual trauma are terms

specific to certain armed forces. Legislation, policy, and coding standards use

various terms to address this topic.

Similar terms in different jurisdictions may or may not carry the exact

meaning or definition.

In the general context of work-related claims, my preferred

terms are “psychological injury” and “mental

health injury” . Mental health

condition, mental health injury, psychological injury, mental health challenge,

and similar terms are used in cited material.

Diagnosis or criteria in the

DSM-5-TR, ICD-11, and equivalent classification systems are not

always the same as those used in practice, policy, or legislation. Certain mental health disorders including

PTSD do appear in these references and generally have specific meanings that

are consistent across jurisdictions but may not be consistently applied or

reflected in statistical reports. This variation in terms makes

interjurisdictional comparison more difficult.

Tracking mental injury statistics in Workers’ Comp and

Disability Insurance

Workers’ compensation recognition of the relationship

between work and psychological injury, particularly in the absence of physical

trauma, has lagged the scientific acceptance. Where short and long term disability (STD and

LTD) insurance or social security disability insurance plans (SSDI in the US) are

available, they are often accessed before (or instead of) filing a workers’ compensation claim. The threshold for

STD, LTD and SSDI is “disability” from employment while workers’ compensation claims

must first establish a work-related cause before considering the issue of

disability.

The Canadian data [from the Association of Workers’

Compensation Boards of Canada – National Work Injury Statistics Program]

reflect a rising trend in accepted work-related

mental disorder claims (7,378 in 2022). While the overall trend in work-related

time-loss injuries was declining (at least until the COVID-19 pandemic),

time-loss claims involving mental disorders or syndromes have trended upward.

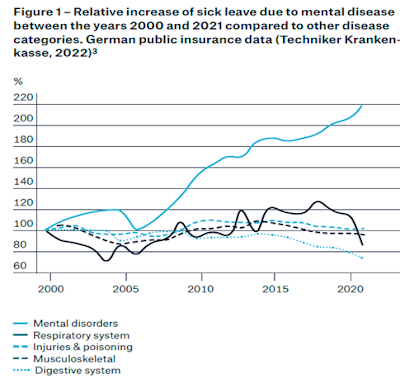

The shape of the

index line for mental health conditions in the Australian data reminded

me of a Munich Re study that looked at the relative increase in sick leave due

to mental disease over a similar period, [See Munich Re, Mira Risk Review:

Munich Re’s Mental Health Calculator, 2022 at https://www.munichre.com/content/dam/munichre/contentlounge/website-pieces/documents/MunichRe-MRRP-Menthal-Health-Calculator_en.pdf] Munich Re notes:

"Mental health

conditions are an increasing challenge globally, but most noticeably in

industrialized countries.

… the rise in incidence is reflected in higher numbers of

life insurance applicants disclosing mental diseases as well as increased

numbers of claims

…most mental health conditions are considered chronic or

recurrent and have a high correlation with other health issues, despite good

treatment.

…complexity in managing mental health conditions is the

rule, rather than the exception.”

"

Sun Life Canada reports 24% of all new short-term disability (STD) claims and 32% of new long-term disability (LTD) claims are for mental illness. The greater complexity and longer duration of these claims account for a disproportionate 45% of claim costs. (See SunLife, Changing Times: evolving the approach to disability management, 2021 at Changing times: evolving the approach to disability management | Sun Life).

Social Insurance mental injury data

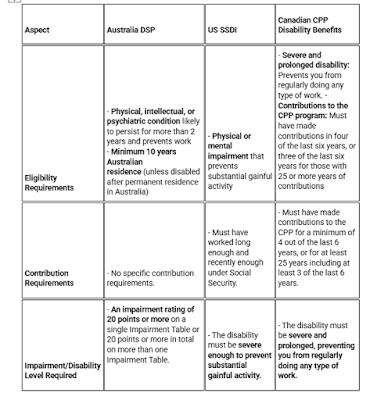

Social insurance generally covers a wider population than workers’ compensation but may reflect trends that are felt by workers’ compensation and disability insurance. The following table highlights aspects of the Australian Disability Support Pension (DSP), US Social Security Disability Insurance (SSDI), and Canada Pension Plan – Disability.

US Social Security provides benefits to workers for certain disabilities. Looking only at the subset of Social Security Disability Insurance (SSDI) for workers who have filed for workers’ compensation or public disability benefits, musculo-skeletal diagnosis dominate. Note, however, that the diagnostic categories involving mental disorders are significant:Changes in coding definitions make a time series using this

subset of SSDI data difficult but it appears that the representation of mental

disorders in this subset has fallen between 2010 and 2022. Looking only at this medical category of SSDI

claims, and using only table 34 in the Annual Statistical Report on the Social

Security Disability Insurance Program for each year, the combination of “Depressive,

bipolar, and related disorders” or “Mood

Disorders” with the “Other” category have fallen from about 14.1% (2010) to 9.3%

(2022) of beneficiaries who have filed for workers' compensation or public

disability benefits.

The Canada Pension Plan Disability (CPP-D) system covers

persons with contributions to the plan who suffer a “severe and prolonged”

disability. Unlike in the US SSDI, I

could find no data isolating just those who had also filed workers’

compensation claims. The following are

based on December counts of benefit cases paid each year 2011(325,620 cases)-2023

(305,679 cases) and isolating mental disorders and all other classes of principle

diagnosis :

Australia Department of Social Services (DSS) provides data

on the demographics of Disability Support Pension (DPS) recipients quarterly. I’ve

selected December data reports and created an index by primary medical condition

isolating the psychological/psychiatric category and all others (excluding the

psychological / psychiatric category):

About 37% of the total

783,625 case were included in the Psychological/psychiatric category in 2023,

up from about 33% in 2015.

I could not find a study quantifying overlaps and possible

substitution of sick leave, social insurance for workers’ compensation mental

injuries. It is possible that workers’ compensation and other forms of

disability compensation (including employer provided sick leave, short-term

disability, and long-term disability) are experiencing similar patterns.

These data suggest mental disorders are a significant issue

for workplace participants, workers’ compensation, social insurance and disability

insurance plans.

Mental Injuries Are Not Always Associated with Physical

Trauma

Most workers encounter a workers’ compensation claim because

of work-related physical trauma. Mental injuries and disorders may well develop

following physical injury, but that is not always the case. SafeWork Australia

found that more than half of mental disorder serious injury claims arose from

work-related harassment, bullying, and workplace pressure.

Safe Work Australia,

Data insights - Snapshot: Psychological health and safety in the

workplace, February 2024

The Canadian data illustrate the distribution of claims by

the nature of the disorder. Post-traumatic Stress Disorder (PTSD) tops the list

but occurs in combination with other disorders and physical injuries. With

PTSD, adjustment disorder, stress, and anxiety contribute to making up the

majority.

While the

range of descriptions noted is wide, recall that these data are for accepted

time-loss claims. That means the

adjudicative authority has determined the work-relatedness of the loss. Many cases of a similar nature may be denied

for mental disorders or injuries. More

on the standard and burden of proof in

the next part of this series.

Employees

with employer provided or employee group

plans for short or long-term disability may seek coverage through those plans.

As noted in earlier posts, many STD and LTD carriers will require claimants to

file claims with workers’ compensation or social insurance plans as a condition

of coverage under LTD or STD.

Who

suffers mental disorder injuries?

The following table lists the top 15 Canadian time-loss claims coded for mental disorders by occupation (Minor grouping level, first four digits of National Occupational Classification- Canada) by the number of accepted time-loss claims from 2020 to 2023:

Please note

that most of these occupations have something that might not be immediately

obvious: high levels of unionization. This

may contribute to greater awareness of health and safety issues as well as

better advocacy supports that contribute to greater success in claim filing. The relatively lower numbers of accepted

mental disorder claims among retail clerks may be more reflective of lower

levels of unionization than lower exposure to harms.

Australian workers’ compensation data are grouped more by industrial sector but

reflect a similar industrial distribution. The “Public administration and

safety industry” includes police services, investigation and security services,

fire protection, other emergency services, and correctional and detention

services. The following figure appears in Safe Work Australia’s data report on “Psychological

health and safety in the workplace”:

How Representative Are These Data?

Both the Canadian and Australian workers’ compensation data

have gaps and inconsistencies that likely understate the extent of work-related

mental disorders in the workplace. Data

for all jurisdictions in either country are not reported in all years. There are no corrections or adjustments for

changes in legislation that may occur over reported periods of time. So, these data may not fully represent what

is happening in either country’s workers’ compensation system.

Direct comparisons between countries are further complicated

by differences in classification systems and coding practices. At best, these data likely reflect broader

trends.

That said, trends for individual jurisdictions over time are

further complicated by changes in definitions, interpretation, diagnostic

methods, adjudicative practice, mix of industries, and a host of other issues within the jurisdiction. Factors such as growing recognition of the

reality of work-related mental injuries and declining stigmatization of mental

disorders will likely impact reported claims but are difficult to assess.

To be clear, work-related mental injuries are real and despite

the shortcomings in the available data, what we have available provides a good indication

the reality of work-related mental injury is being somewhat (if not fully)

recognized.

Whether because of physical injury, a complication of

treatment, or work-place conditions, workers are being harmed. That harm is

significant and as life-altering for the bullied construction worker as it is

for the burned-out air-traffic controller or the PTSD afflicted first

responder.

Summary

Data from multiple sources show:

·

Mental disorders are a significant issue for

workers’ compensation, disability insurers and social insurance entities

·

Increasing proportion of workers’ compensation

claims in at least some jurisdictions

·

Increasing associated costs

Next time

These data on of

mental disorders demonstrate the significance of the issue. They also illustrate some of the key

challenges in comparing data across jurisdictions.

In Part 2, we will explore some of the differences in the

determination of claim acceptance in workers’ compensation programs and

consider initiatives for prevention and treatment.